In the dynamically evolving legal landscape, law firms are continuously seeking ways to improve efficiency and productivity. Automation has emerged as a powerful tool for optimizing legal case management, enabling legal professionals to concentrate their time to complex tasks. By leveraging repetitive tasks, such as document analysis and case management, automation can substantially reduce administrative burdens and improve overall effectiveness.

- Moreover, automation can reduce the risk of mistakes, ensuring that legal cases are processed with accuracy and detail.

- With the incorporation of automation technologies, law agencies can gain a competitive advantage in today's challenging legal market.

Automating Financial Services for Enhanced Efficiency

Financial services present a dynamic and fluctuating landscape. To succeed in this environment, financial institutions need to embrace automation to enhance efficiency and provide a superior customer journey.

Automating key processes such as customer onboarding can greatly minimize manual effort, freeing up employees to focus on more strategic tasks.

Furthermore, automation can result in improved accuracy, faster turnaround times, and reduced costs. Financial institutions that implement automation technologies are well-positioned to optimize their operations and deliver a more efficient customer experience.

A Deep Dive into Legal Operations Automation

In today's dynamic legal landscape, law firms and corporations alike are constantly seeking ways to optimize efficiency and productivity. Staff automation has emerged as a transformative solution, enabling legal operations departments to leverage technology to automate repetitive tasks. This comprehensive guide delves into the world of staff automation in legal operations, exploring its advantages, implementation tactics, and potential impact on the future of the legal profession.

From document review and contract management to billing and client intake, staff automation can revolutionize critical areas within legal operations. By automating these tasks, legal professionals can free up valuable time and resources to focus on more strategic projects.

- Furthermore, staff automation can improve accuracy, reduce errors, and streamline workflows.

- This consequently leads to increased efficiency, reduced costs, and a more favorable client experience.

Utilizing Automation for Robust Compliance Monitoring

In today's evolving regulatory landscape, ensuring adherence has become paramount. Manual monitoring methods often fall inadequate, struggling to keep pace with the volume and complexity of data. Leveraging automation technologies provides a robust solution for enhancing compliance monitoring processes. By mechanizing repetitive tasks, organizations can enhance accuracy, reduce human error, and free up valuable resources to focus on more critical initiatives.

- Automated systems can effectively process vast amounts of data in real time, identifying potential compliance concerns promptly.

- Task automation helps ensure consistent application of guidelines, minimizing the risk of failures.

- Information gathered through automated monitoring can be utilized to highlight trends and areas for improvement, fostering a culture of continuous compliance.

By implementing automation, organizations can achieve a higher level of confidence in their compliance posture, mitigating risks and preserving their reputation.

Streamlining Financial Services Through Automation: Cost Reduction and Enhanced Precision

Financial services firms are increasingly utilizing automation to optimize their operations and achieve significant benefits. Automation allows financial analysts to execute routine tasks, releasing valuable time and read more resources for complex initiatives. By streamlining processes such as transaction processing, financial services can minimize operational costs, boost accuracy, and offer a optimized customer experience.

- Furthermore, automation can eliminate the risk of manual mistakes, ensuring the validity of financial transactions and statements.

- Consequently, financial services institutions that embrace automation are strategically aligned to succeed in the evolving financial landscape.

The future of Compliance: Automated Monitoring Solutions

As the compliance ecosystem evolves at an unprecedented pace, organizations are facing ever-increasing pressures to ensure fulfillment with a complex web of legal frameworks. Traditionally,this has involved manual processes that are often resource-intensive, susceptible to human error, and struggle to keep pace with the dynamic nature of regulatory demands. However, the rise of automated monitoring solutions is transforming the outlook of compliance.

- These innovative solutions leverage artificial intelligence to continuously monitor vast amounts of information, identifying potential violations in real time.

- , organizations can improve compliance efficiency, reduce the risk of fines, and free up valuable resources for core business functions.

Moreover,automated monitoring solutions often provide actionable insights that enable organizations to proactively address compliance risks. This shift towards automation is poised to reshape the future of business operations, empowering organizations to navigate a complex regulatory environment with greater confidence and agility.

Alana "Honey Boo Boo" Thompson Then & Now!

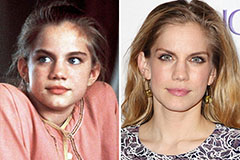

Alana "Honey Boo Boo" Thompson Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Nancy Kerrigan Then & Now!

Nancy Kerrigan Then & Now!